Judgement Enforcement & Collection - bramnick creed Things To Know Before You Get This

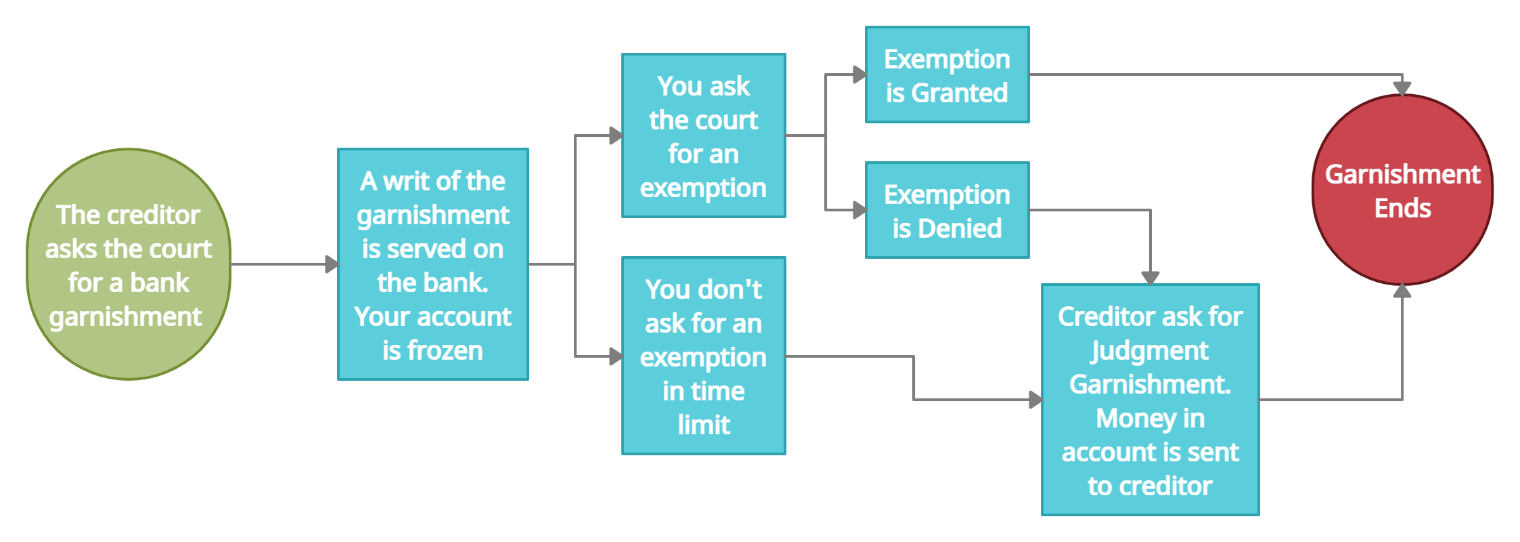

Subjects on this page: What is a Garnishment? To "garnish" is to take property (usually a portion of someone's wages or pay) by court order. Garnishment is a proceeding by a creditor to gather a debt by taking the residential or commercial property or properties of a debtor. Any person or company can be based on garnishment.

The individual holding the home of the offender, or who is indebted to the offender, is the. A garnishee can be a bank, a company or other individual who holds home that comes from the judgment debtor. To gather https://diigo.com/0nvgeu owed, the complainant needs to first get a final judgment or order against the offender in court.

A garnishment proceeding identifies whether the debtor has any assets that can be used to pay a judgment. When a judgment has been entered, the creditor can collect what is owed. Judgments are enforceable in Maryland for 12 years and they can be renewed. Interest accrues on judgments at the legal rate of 10% or 6%.

The 5-Minute Rule for Wage Garnishments and Bank Account Levies in Maryland

Code Courts and Judicial Procedures 11-107 Two typical types of garnishment procedures are garnishment of salaries and garnishment of home and assets, like a bank account. Garnishment Procedure in District Court: the following processes are based on Rules of Treatment. They use if you have a judgment in the District Court of Maryland.

Rules Title 3, Chapter 600. The rules for garnishing residential or commercial property in Circuit Court are extremely comparable, however, there may be some distinctions. See Md. Guidelines Title 2, Chapter 600. Notably, the Circuit Court does not have kinds for judgment financial institutions to use. Some Circuit Courts might enable you to use District Court kinds.

If you have concerns about court treatment, talk with a lawyer. Read the Guidelines: Maryland Rules, Title 3, Chapter 600; Maryland Rules Title 2, Chapter 600 The creditor begins the garnishment process by submitting a Demand with the court. There is a cost to file the Request. After the Request is submitted, the court clerk or a judge signs the Demand and it becomes a Writ of Garnishment.